income tax malaysia rate

However if you claimed RM13500 in tax. Petroleum income tax Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

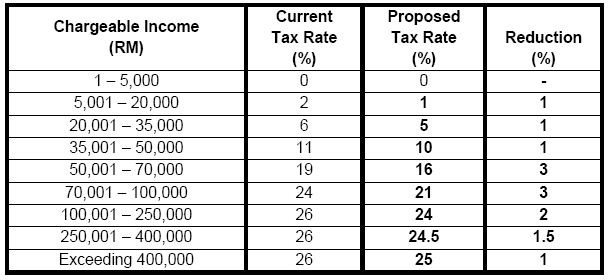

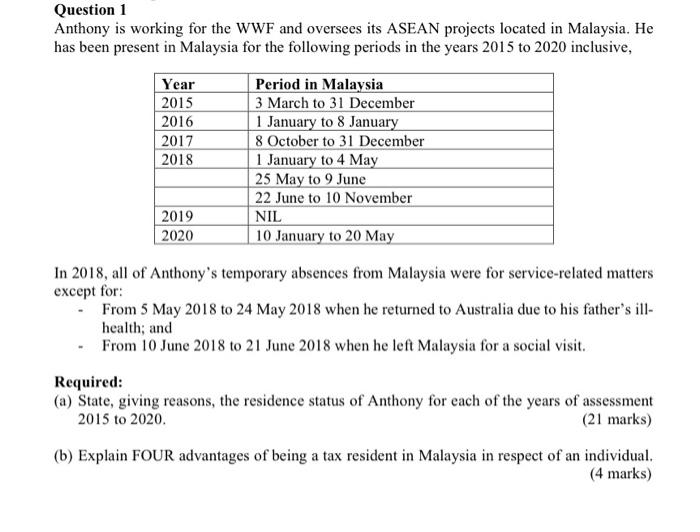

He said the income tax rate of resident individuals will be reduced by two percentage points for the range of taxable income between RM50000 and RM100000.

. On the First 5000. On the First 5000 Next 15000. Govt proposes higher tax rate for individuals with RM250001 to RM400000 taxable income.

Finance Minister Datuk Seri Tengku. Alex Cheong Pui Yin - 7th October 2022. Tax reliefs and rebates There are 21 tax reliefs available for individual.

According to the Inland Revenue Board Of Malaysia LHDN failure to pay your taxes on time will incur a 10 increment on your payable tax. Govt To Reduce Individual Tax Rates For Two Income Brackets By 2. Total tax amount RM150 Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to LHDN.

Following table will give you an idea about company tax computation in Malaysia. On the First 2500. Those who earn taxable income of between RM50001 and RM70000 will see their tax rate reduced from 13 per cent to 11 per cent while those earning between RM70001 and.

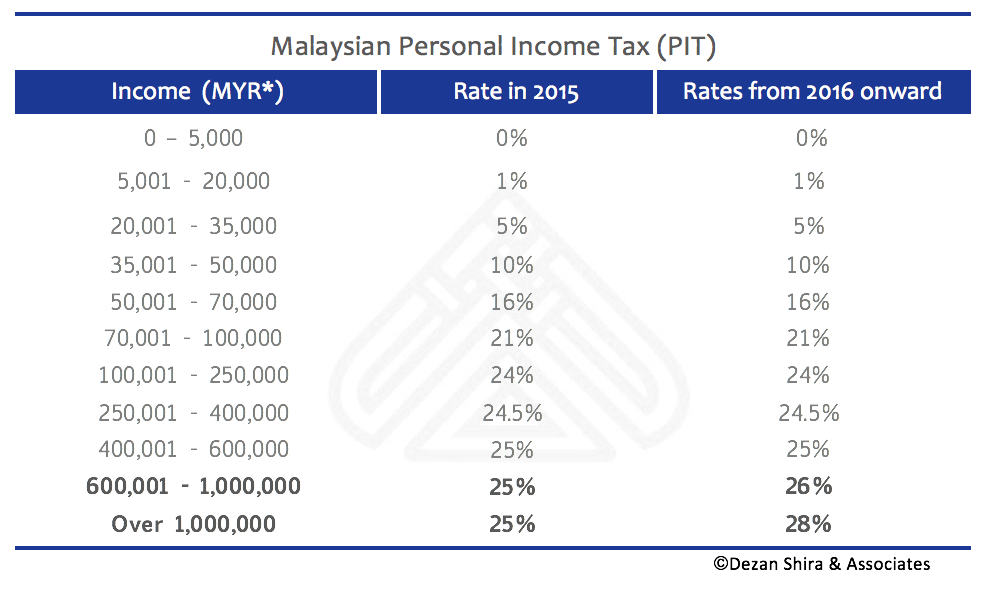

Chargeable Income Calculations RM Rate TaxRM 0 2500. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

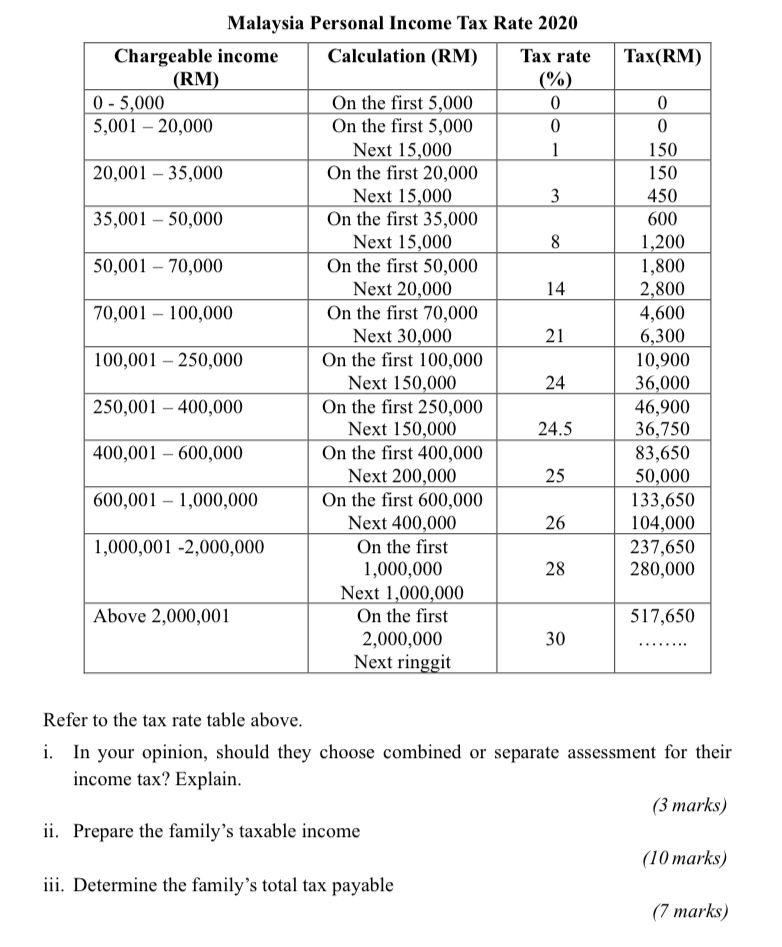

Additionally the tax rate on those earning more than RM2 million per year has been increased from 28 to 30. This tax rate ranges from 0 on the first RM5000 to a maximum of 30 on taxable income exceeding RM2000001. The Malaysian corporate standard income tax rate is 24 applicable to resident or non-resident companies that earn revenue inside Malaysia.

However non-residing individuals have to pay tax at a flat rate of 30. From the Assessment Year 2016 to the Assessment Year 2019 the. On first RM600000 chargeable income 17 On subsequent chargeable income 24 Resident company with paid-up capital above RM25 million at the beginning of the basis period 24.

It will be raised to 25 from current 245 Finance Ministry says. A non-resident individual is taxed at a flat rate of. Individual Income Tax Rate.

Therefore if youre a very busy person. Additional rates will be implemented in case of special instances of income. Paid-up capital up to RM25 million or less.

Malaysia has a territorial tax. Rate On the first RM600000 chargeable income. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

An effective petroleum income tax rate of 25. 13 rows 30. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the.

On the First 5000. On the First 20000 Next. Malaysia Residents Income Tax Tables in 2022.

If taxable you are required to fill in M Form. This will be in effect from 2020. Tax Rate of Company.

Calculations RM Rate TaxRM 0 - 5000.

As Tax Changes Brew In Congress Outlook Is Grim For Pass Through Owners

Budget 2014 Personal Tax Reduced In 2015 Tax Updates Budget Business News

World S Highest Effective Personal Tax Rates

Screen Shot 2016 02 14 At 2 35 35 Pm Asean Business News

Malaysia Personal Income Tax Rates 2021 Ya 2020

Income Tax Formula Excel University

Solved The Following Tax Rates Allowances And Values Are To Chegg Com

Singapore Raises Income Tax Rates For Top 5 Per Cent And Malaysia Anilnetto Com

Malaysia Personal Income Tax Guide 2020 Ya 2019

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

Erwan Plans To Buy A House He Has Two Options To Chegg Com

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

How To Calculate Income Tax In Excel

Why It Matters In Paying Taxes Doing Business World Bank Group

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

Comments

Post a Comment